PARLIAMENT: Billionaire Sudhir Ruparelia has on Wednesday told Parliament’s Commissions, Statutory Authorities and State Enterprises (Cosase) that Bank of Uganda (BoU) officials closed Crane Bank in total disregard of the law. He now wants BoU pays $23.3 million (Shs85,724,553,256) of shareholders capital at the closure of the bank.

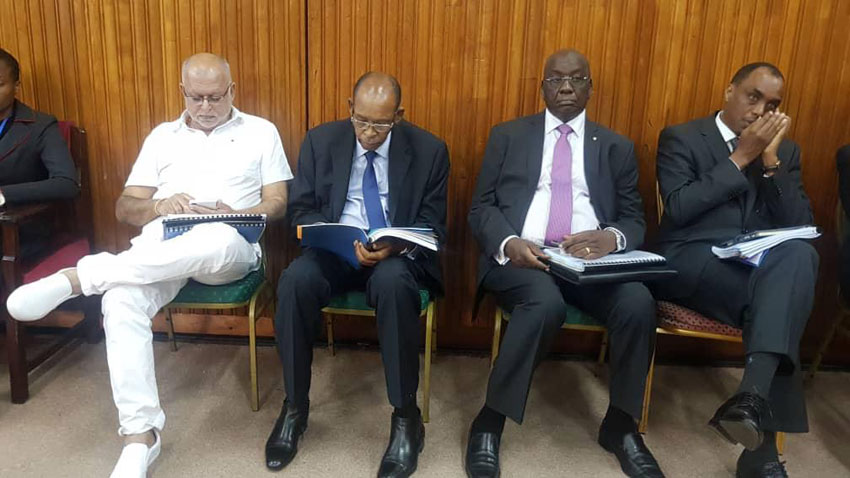

The Ruparelia Group chairman, who was appearing before Cosase to answer queries about the controversial closure of Crane Bank and six other now defunct banks, didn’t ask for damages.

The Abdu Katuntu-led committee is in the process of winding up a probe into how BoU closed and disposed of banks in receivership.

On Monday, Cosase met shareholders of National Bank of Commerce, Teefe Bank, Nile River and SIL Investments Limited while on Tuesday, those of International Credit Bank Ltd, the Co-operative Bank and Greenland Bank appeared before Mr Katuntu.

Asked whether Crane Bank has the Inventory Report arising from the closure of the bank, Ruparelia said, “we have not been availed the Inventory Report and going by the Auditor General report, BOU has not shown the report either.”

Mr Ruparelia also said Bank of Uganda should provide accountability for money purportedly invested in Crane Bank.

“We believe some of this money did not end up in Crane Bank,” said Ruparelia.

Sudhir was accompanied by other bank board members including Mr Joseph Biribwona, the defunct bank’s chairman, who said BoU had the option of lending money to Crane Bank, or take it over and manage it or encourage shareholders to fasten the process of getting investors before closing it.

Instead, the central bank handled the take over and sale of Crane Bank in an illegal manner, disposing off the bank in 2016, to Dfcu at Shs200bn.

“….. Crane Bank had made a huge milestones, received awards as a leading financial Institution in Uganda and rated as the leading bank in Uganda only to be watered down by the irresponsibility of Bank of Uganda (BOU) officials,” Mr Biriboona told the Abdu Katuntu-led committee. “Crane bank offered its branches as security and also got a third party security of Boulevard building along Kampala Road, to acquire a loan in order to save and recapitalise the Bank, but all these was ignored by BOU.”

Last year BoU officials led by Governor, Emmanuel Tumusiime Mutebile failed to avail accountability of the Shs478bn that was allegedly injected in Crane Bank while it was under receivership.

Ruparelia joins a list of bank owners seeking compensation.

On Tuesday, the shareholders of Greenland Bank have faulted BoU of mismanaging the property of the institution and demanded Shs700 billion as compensation. Earlier on Monday, the former owners of National Bank of Commerce (NBC) demanded for Shs295 billion for loss of business over their closure.

Mr Katuntu has about two weeks to submit his report on the probe into the dealings of Bank of Uganda.