OpEd;

On June 27, 2022, The Court of Appeal halted the auctioning and sale of prime properties belonging to Kampala businessman Patrick Bitature over failure to clear a debt amounting to US$ 32 million having borrowed US$10 million from Vantage Mezzanine Fund II Partnership (Vantage), a South African lenders in 2014 .

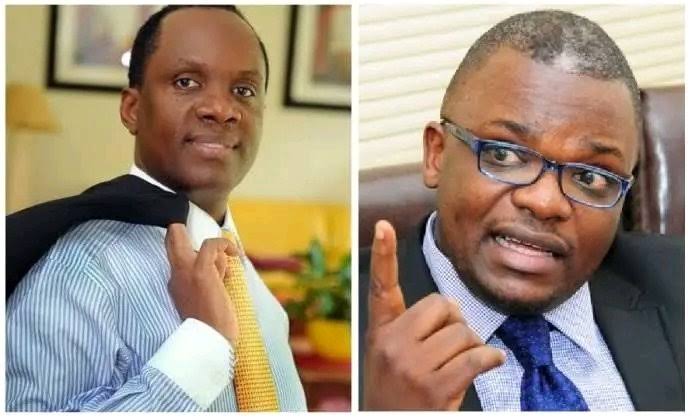

Justice Christopher Gashirabake, sitting as a single judge, held that there was an eminent threat that the properties could be auctioned and sold despite a pending case. He tried to give Bitature some sleep as he battles the giant Vantage.

But the judge to save Bitature’s properties for a while, said, “There is all evidence that there is a real threat of sale/disposal of the property before determination of the main arguments of jurisdiction of this court can be determined.”

He added: “For this reason, I grant the protective order sought. Any further form of threat of sale or dealing in the advertised property is hereby stayed until the determination of the application of interim order of stay. I order accordingly. I give no order as to costs.” This ruling does not absolve Bitature. Legal minds believe he borrowed the loan willingly and he must pay, which calls for government’s assistance since his companies employ many Ugandans as well as being amongst top taxpayers in the country.

The properties that were advertised on May 18 in various newspapers and could still be sold include Elizabeth apartments in Kololo, Protea Hotel (Skyz’s Hotel) in Naguru, Moyo Close apartments and Kololo Gardens in Kampala. By stopping Vantage from selling these properties, court wants government to help Bitature financially to rescue these important properties.

Remember lawyers Robert Kirunda, Wasige and bailiff Katerega advertised the selling off his properties and still believe their client Vantage can still sell the properties to recover their monies. The battle is not lost, given that the main case still subsists. Vantage has the advantage of seeking international justice, if things do not go their way in Uganda.

Government has been rescuing many Ugandan companies and individuals. It must also now rescue Bitature by way of paying Vantage but government can arrange with Bitature to pay back.

Bitature on various social media platforms and mainstream media admitted he willingly sought a loan from South African to finish his construction activities as well as paying an outstanding loan then. Which means the Ugandan businessman is keen on paying his debt, even though current circumstances may not allow him since Vantage want their money as soon as possible.

We must commend the efforts of Lawyer Fred Muwema who ensured a court order stopping the sale of the properties was secured. Now government can do something for Bitature, given that he has also helped government in certain areas. Bitature is also a good activist when it comes to social causes. He has contributed to churches and many other socities. We as Ugandans must not sleep over his problems. Government must do something.

Simba Group approached Vantage Capital in 2014, seeking an alternative to the more common and mainstream pure debt funding for business expansion. Consequently, a “Mezzanine Term Facility Agreement” (MTFA) was signed between Vantage and Simba Properties Investment Company (Simba) for $10,000,000 to fund projects within the Group. These projects included the completion of Protea by Marriott Skyz Hotel and working capital for Simba’s ElectroMaxx Power subsidiary. The agreement had a 3-year moratorium (freeze) for repayment of both the principal and interest.

Remember Bitature is also Consul for the Australian government in Uganda. His reputation must be maintained.

Courtsey: Daily Post Uganda Editorial