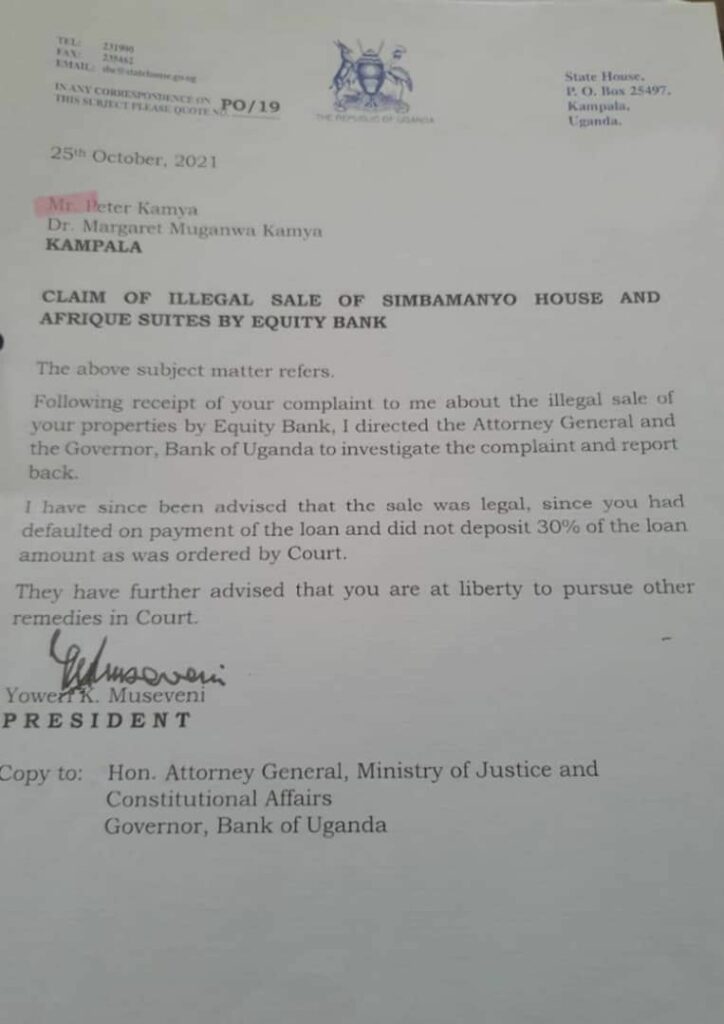

KAMPALA: President Museveni has told Architect Peter Kamya that Equity Bank legally sold both Simbamanyo House and Afrique Suites over unserviced Bank loans. He further advised him to pursue court redress if necessary.

In an October 25 letter, the President earlier petitioned by Mr. Kamya to intervene in the matter indicates that he has been advised by both the Attorney General and the Bank of Uganda that the sale of Mr. Kamya’s properties followed due court process.

The President wrote: “Following receipt of your complaint to me about the illegal sale of your properties by Equity Bank, I directed the Attorney General and the Governor, Bank of Uganda to investigate the complaint and report back to me,”

“I have been advised that the sale was legal since you had defaulted on the payment of the loan did not deposit 30 percent of the loan amount as was ordered by the court. They have further advised that you are at liberty to pursue other remedies in court,” the President wrote.

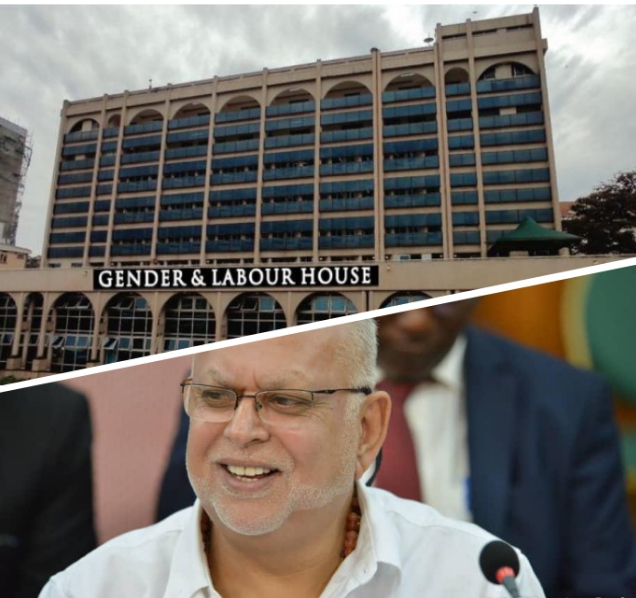

Mr. Kamya’s Simbamanyo House was in October 2020, sold to tycoon Sudhir Ruparelia’s Meera Investments at UGX 18.5 billion while his Afrique Suites was sold to Luwaluwa Investments.

Mr. Ruparelia has since renamed Simbamanyo House to Gender & Labour House.

After losing a Court Appeal application that tried to reverse the sale of Simbamanyo House and Afrique Suites, Mr. Kamya then sought the intervention of President Museveni, who in September wrote to both Governor Emmanuel Tumusiime Mutebile and Attorney General Kiryowa Kiwanuka for advise.

An internal report of the Bank of Uganda shed light on the events tracing the auction and sale of Simbamanyo House and Afrique Suites — both properties of city businessman Peter Kamya — by the Equity Bank and flagged the transaction fair and done under the law.

President Museveni on September 3, directed Governor Emmanuel Tumusiime Mutebile to investigate circumstances under which Equity Bank sold the properties after Mr. Kamya and his wife petitioned the president but the BOU report, tracing the chronology of the events indicate that Mr. Kamya’s troubles started way back in 2016 long before the Covid-19 pandemic, one of the major reasons the city businessman gave for his failure to meet his loan obligations as justification for the President’s intervention.

But the BOU report also shows that Mr. Kamya continued to receive billions of rent payments until May 2020, but did not remit any for his loan obligations.

The report, effectively the Bank of Uganda’s representation to President Museveni, following his directive for an investigation presents Mr. Kamya’s version of the events was misleading after losing successive court battles that started with him taking on Equity Bank, after he was pressed to honor his obligations.

“From 2016 to September 2020, Mr. Kamya continued to receive from the mortgaged properties without considering paying back the loan but instead chose to ignore the agreement as he opted for legal means even with reminders no payment came through,” the detailed report, chronicling the events surrounding the standoff between Simbamanyo Estates Limited and Equity Bank Uganda Limited and Equity Bank Kenya Limited.

The BoU report indicates that between 2012-2014, Mr. Kamya took a loan in excess of $7.1 million before interest and secured the said facilities by mortgaging LRV 2220 Plot 2 folio Lumumba Avenue (Simbamanyo House) and properties comprised in Kyadondo block 243 Plots 95, 958,2794,17800 and block 237 Plot 95 land at Mutungo (Afrique Suites).

“And by October 8, 2020, Simbamanyo did not deposit the said 30% as ordered by the court. In the absence of any further orders from court stopping the auction, the mortgaged properties were sold after a public auction, in accordance with provisions of the Mortgage Act and the Mortgage Regulations to the highest bidders”.

The report says in 2016 Simbamanyo defaulted on those loan facilities and to buy time filed HCCS No.544 of 2016 alleging that its accounts had been wrongly debited and therefore, it refused to make any further payments of its loan obligations.

The report further says an independent report was undertaken by Ernest and Young showed that the discrepancy was a total of only $442.“In mid-2017, Equity Bank Uganda Limited began foreclosure proceedings against Simbamanyo to recover the outstanding loan and Simbamanyo filed Miscellaneous Application No.1159 of 2017 seeking a temporary injunction stopping Equity Bank Uganda Limited from foreclosing and selling the mortgaged property” reads the report from BoU sent to President Museveni. In October 2017, Justice Billy Kainamura issued his ruling in the Miscellaneous Application No. 1159 of 2017 and, in accordance with the Mortgage Property Act, and ordered Simbamanyo Estates to deposit 30% of the outstanding loan amount otherwise Equity Bank Uganda Limited would be allowed to sale the properties.