PARLIAMENT: Parliament’s Committee on Commissions, Statutory Authorities and State Enterprises (COSASE) has in groundbreaking recommendations, called for compensation of directors in three banks, including tycoon Sudhir Rupareria’s Crane Bank Ltd, after they faulted Bank of Uganda for negligently disposing of several defunct banks and breaking several provisions of the Financial Institutions Act (2004).

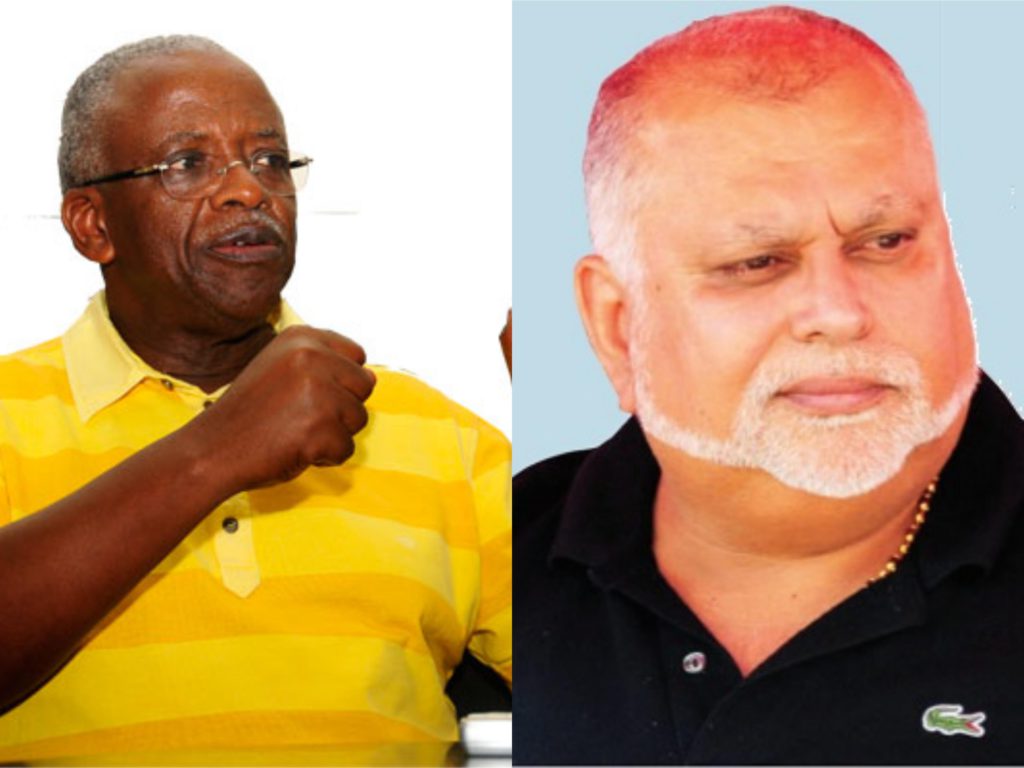

In their report, presented before the floor of parliament on Thursday, the MPs led by outgoing COSASE Chairman Abdu Katuntu found that the process of selling Global Trust Bank, National Bank of Commerce and Crane Bank on several instances “contravened section 95 (3) of the FIA 2004” and lacked the principles of “prudence, transparency and fairness” enshrined in the constitution and the FIA Act and want the Bank of Uganda officials involved in the seizure and irregular sale of the banks held responsible.

“The BoU having failed to value the assets and liabilities of GTB, NBC and CBL and considering the lapse of time and impossibility in revaluation of the assets should address the probable financial loss involved,” the report recommends.

Directors in the three banks variously faulted Bank of Uganda and her senior officials for acting arbitrarily at the time the officials carried out the bank closures.

The National Bank of Commerce whose key shareholders include the former powerful Prime Minister Amama Mbabazi, the current Prime Minister Dr. Ruhakana Rugunda and prominent personalities from Kizezi region was closed on September 27, 2012, by the Central Bank on allegations that it lacked the minimum capital requirement of Shs 10bn.

Appearing before the committee the shareholders of the NBC led by the Chairman Board of Directors, Matthew Rukikaire noted that their bank was summarily, arbitrary and illegally closed on orders of Justine Bagyenda who was the Executive Director, Bank Supervision. The directors want compensation in billions of shillings. Global Trust Bank, MPs found, was controversially sold to Dfcu Bank through a confidential purchase agreement in which BoU entered into with Dfcu Bank on July 10, 2014, before the bank was eventually closed on July 24, 2014.

The central bank in October 2016 closed Crane Bank Ltd, previously one of the best performing banks before controversially selling it dfcu Bank in January 2017 for a paltry Shs 200 billion.

After a raft of evidence before Mr Katuntu’s committee, it is understood that Mr Rupareria is more sinned against after the central bank sought to blame him for the problems leading up to the closure of the bank after leads indicated a more rotten system at BoU.

The COSASE inquiry into the conduct of Bank of Uganda and it’s officials in the closure of seven banks, with some ending up in massive controversy that lasted for the last three months has brought into been focus the mismanagement of closed banks by BoU after the Auditor General Mr John Muwanga issued a stinging criticism of the central bank in a special audit that cited massive flaws in the closure of Teefe Bank (1993), International Credit Bank Ltd (1998), Greenland Bank (1999), The Co-operative Bank (1999), National Bank of Commerce (2012), Global Trust Bank (2014) and the sale of Crane Bank Ltd (CBL) to dfcu (2016).