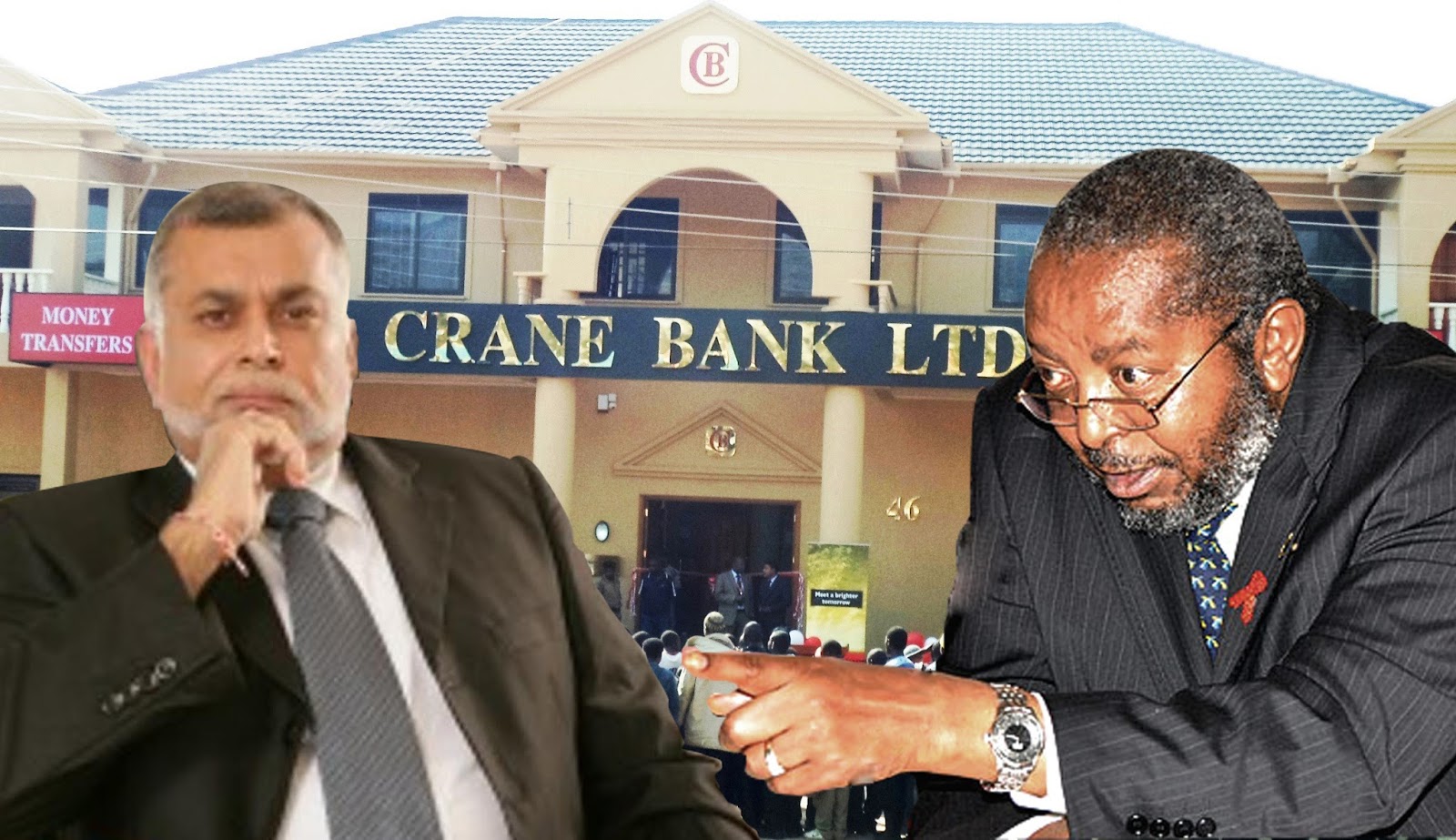

PARLIAMENT – Bank of Uganda officials have come under intense fire for wastefully spending Shs 478b on Crane Bank closure that needed only Shs157b capitalization before it was finally sold to DFCU Bank.

On Wednesday morning, Mr Benedict Ssekabira, the Director Financial Markets Coordination insisted the figure was Shs157b after COSASE Chairman Andy Katuntu asked how much Crane Bank needed to return to adequate capitalisation at the time of closure.

MP Medard Ssegona asked for documentary evidence before Aruu MP Odonga Otto questioned why Shs478b was spent on a bank that needed only Shs157b at the time of closure.

“If Crane Bank was in deficit of 157b, why did you use Shs478b to clear mess?

Why didn’t BoU just capitalise Crane Bank with 157b,” MP Odonga Otto queried.

MP Abraham Byandala wondered why there was a rush to take over Crane Bank since it had been given up to end of October 2016 to recapitalise

“A bank can even be recapitalised within a day but it was taken over 10 days before the time it was given in August 2016 MoU,” he said.

BoU spent Shs478b as liquidation support to keep running Crane Bank for three months, before it was sold to DFCU for Shs200b in January 2017.

The central bank in October 2016 closed Crane Bank, previously one of the best performing banks before controversially selling it dfcu Bank in January 2017 for a paltry Shs 200 billion.

On Monday, Mr Katimbo Mugwanya, a former director at BoU who was appointed Statutory Manager for the sale of Crane Bank, admitted that he had bungled up the calculations on how the money that was injected in Crane Bank was calculated, leaving the committee with no option but to adjourn the hearing to Wednesday.

Governor Mr Emmanuel Tumusiime Mutebile told MPs that he did not have figures regarding Crane Bank’s undercapitalisation but was contradicted by Mr Benedict Ssekabira, the Director Financial Markets Coordination, who said Crane Bank required further injection of Shs157b for it to remain afloat.

The Parliament’s Committee on Commissions, Statutory Authorities and State Enterprises (Cosase) is conducting an inquiry into the conduct of Bank of Uganda and it’s officials in the closure of seven banks, with some ending up in massive controversy.

Ms Bagyenda, a key figure in the central bank’s drastic measures now under review is considered a prime witness, having been behind the drastic closure and handover of Crane Bank to dfcu Bank in 2017, before the fall out forced her out of the central bank.

The MPs’ inquiry is also focusing on the mismanagement of closed banks by BoU after the Auditor General Mr John Muwanga issued a stinging criticism of the central bank in a special audit that cited massive flaws in the closure of Teefe Bank (1993), International Credit Bank Ltd (1998), Greenland Bank (1999), The Co-operative Bank (1999), National Bank of Commerce (2012), Global Trust Bank (2014) and the sale of Crane Bank Ltd (CBL) to dfcu (2016).